Audience measurement systems

Technologies

Glossary

Intab definition and loss detection

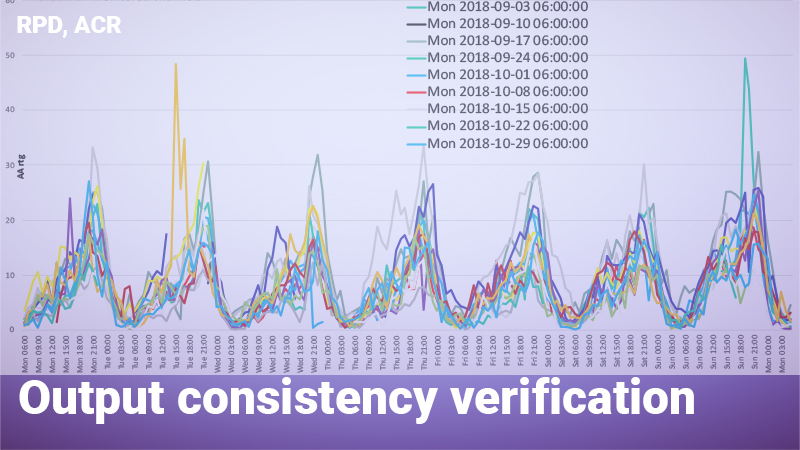

RPD

Capping

DVR time-shifting

VOD

OTT/convergence

Channel management

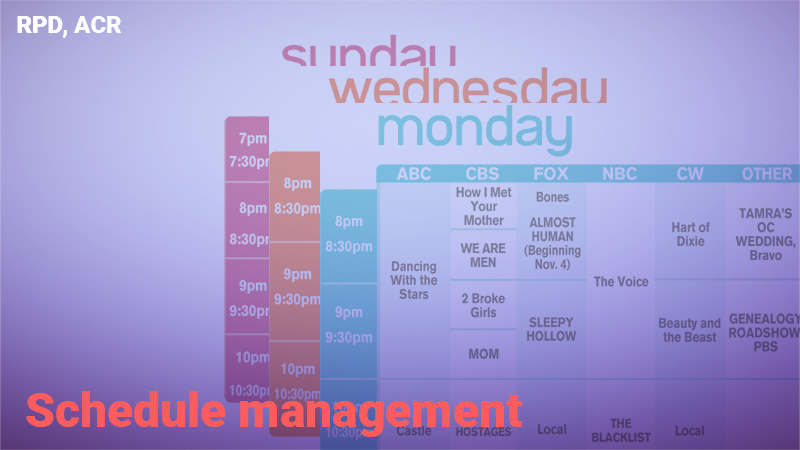

Schedule management

Timezone management

Sample management

STB and middleware testing

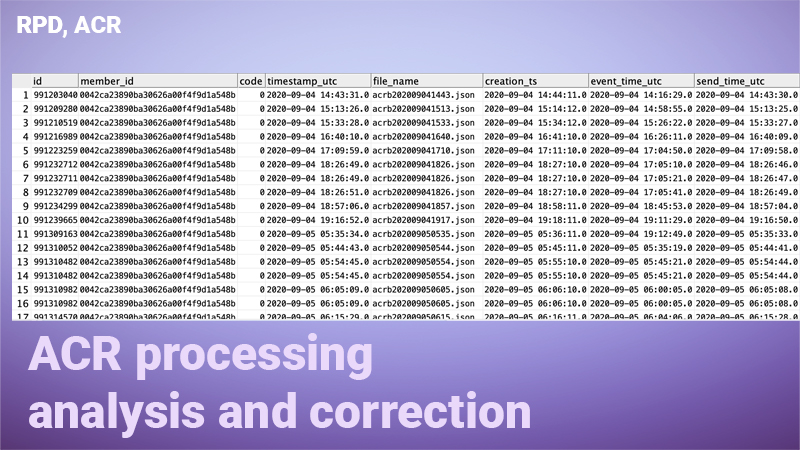

Multiple data collection systems

Multiple delivery platforms

Ancillary broadcast systems